Overview of Illinois Economy (as of November 2025)

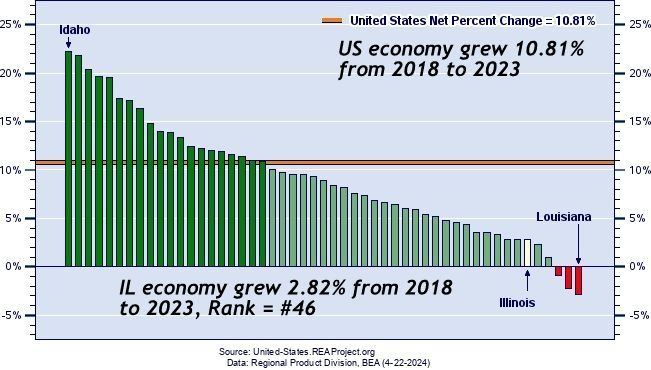

The Illinois economy in 2025 has shown mixed performance, with a contraction in the first quarter followed by a rebound in the second quarter, largely tracking national trends. Real Gross State Product (GSP) is up year-over-year, but growth has been uneven across sectors, with strengths in manufacturing and finance offset by declines in agriculture, utilities, and trade. Unemployment remains relatively low but is projected to rise modestly, while job growth is sluggish. The state faces budget challenges exacerbated by federal policy changes, leading to projected deficits. Overall, Illinois ranks poorly in national economic competitiveness (46th out of 50 states), with GDP growth expected to align with the national forecast of 1.7% for 2025.

IL RANKS #4 IN BURDEN OF REGULATIONS

Compliance adds costs to operations, reducing spend on all items vital to the enterprise

Major Sectors and Performance

- Strengths: Job growth is strongest in private education and health services, information, and financial activities. Manufacturing and finance drove Q2 GDP gains.

- Weaknesses: Declines in manufacturing, professional and business services, trade/transportation, agriculture, and utilities. Corporate profits are falling nationally, impacting taxes.

- Other Trends: Consumer spending is accelerating but faces uncertainty from federal policies like tariffs, which risk supply chain disruptions and inflation in goods. Illinois has a strong international trade presence, though affected by global tensions. Per Grok

Kevin O'Leary is a well-known investment pro who shared his thoughts on our state. HIghlights:

- Taxes are too high, especially property taxes

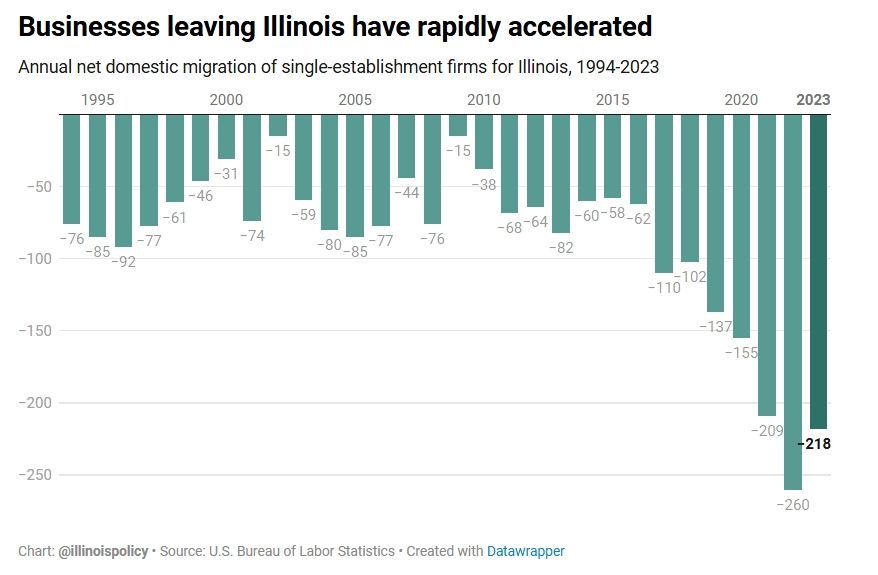

- People and employers are leaving due to high costs of living in IL

- Chicago, the engine of the IL economy, is in cultural and economic decline

- No solutions in sight because IL politicians are focused on keeping their power, not solving problems

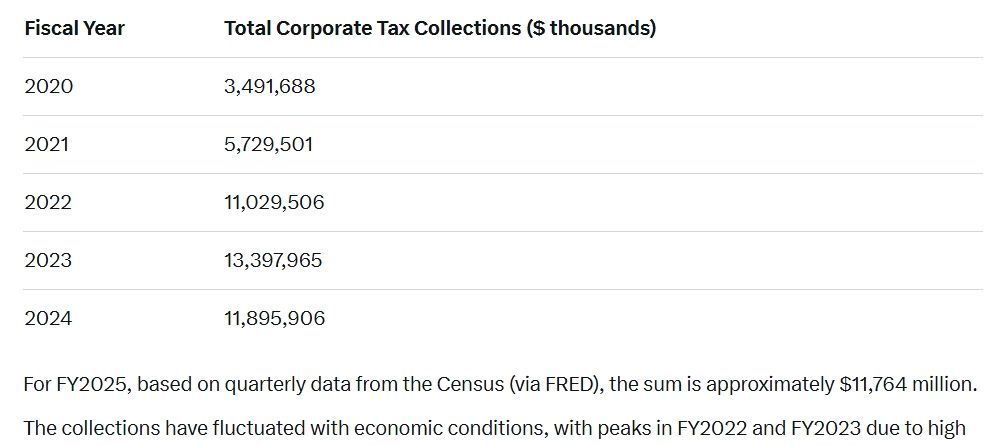

Corporate Taxes are a key component of IL Revenues

The U.S. Census Bureau's Annual Survey of State Government Tax Collections provides corporation net income tax data (in thousands of dollars), which aligns closely with the above for some years but may vary due to gross vs. net reporting or inclusion of additional business income taxes. Per Grok

Note that business taxes peaked in 2023, have declined for the past two years. Why? Possible explanations:

*The decline of businesses in IL. Companies close or leave and take their tax payments with them. Or

*IL businesses are not thriving under the tax and regulatory burden of the state.