STATE TAX BURDEN AND GROWTH OF HOME EQUITY

The relationship between state tax burdens and home equity growth is complex, influenced by factors like economic conditions, migration patterns, housing supply, and the 2007-2008 financial crisis (which caused sharper price drops in some high-tax states near the 2005 bubble peak). Home equity growth is primarily driven by home price appreciation, as it increases the market value of properties (minus any debt).

Based on available data and studies, there appears to be a moderate negative correlation: states with higher tax burdens have generally experienced slower home price appreciation since 2005 compared to low-tax states. This suggests that high taxes may suppress home equity growth to some extent, potentially by making states less attractive for residents and investors, leading to lower demand and price pressures—consistent with economic research on tax capitalization into housing values.

Key Findings from Research

- Studies indicate that higher state income taxes and property taxes are associated with lower home values or slower price growth, as they increase the cost of living and are "capitalized" into reduced housing demand.

- For example, a 1% increase in state income taxes can reduce home prices by an estimated 1-3%, based on causal evidence from tax changes.

- Property taxes also correlate with reduced price volatility and lower overall values, though they can improve affordability in some models by lowering upfront costs.

Per Grok Analytics

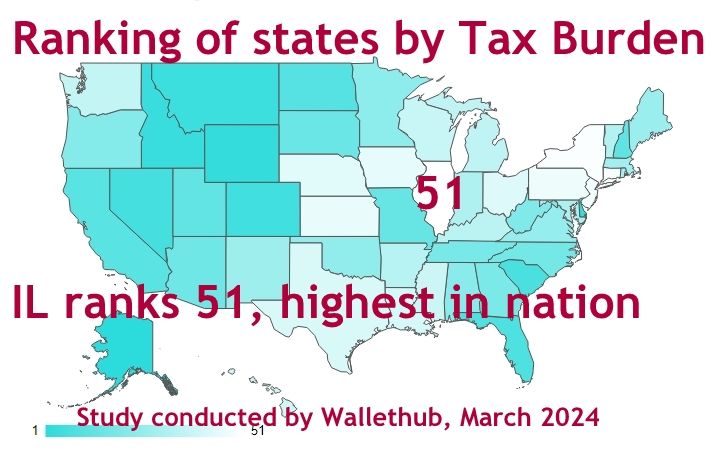

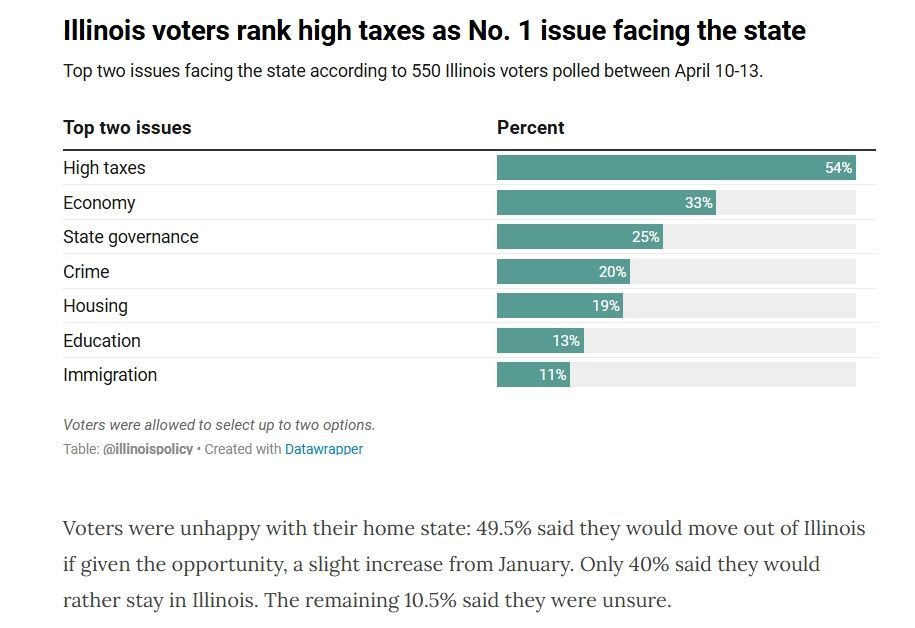

IL leads the nation in tax burden

The scale of state and local taxes in IL is at record levels under the Governorship of Mr. Pritzker.

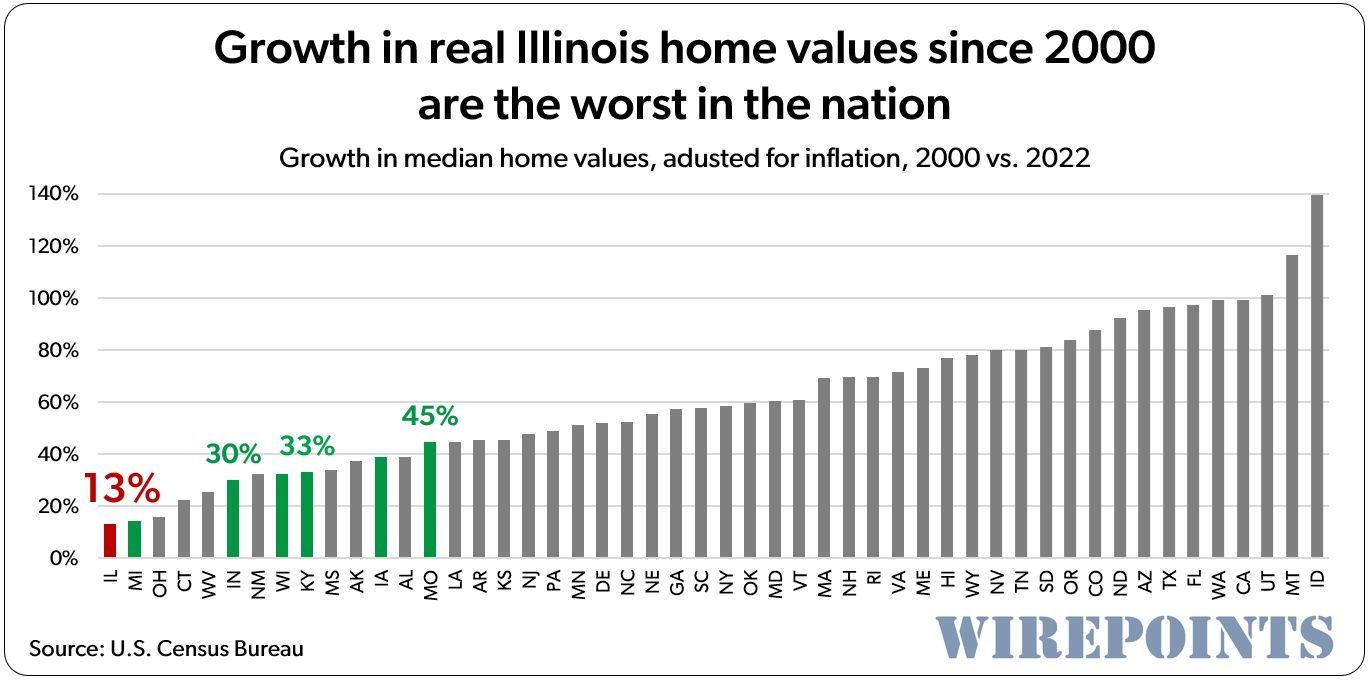

Home Value is a key asset of every American household

Many home owners consider their home a vital asset for future financial security. Annual appreciation in Home Values matters. Over the past twenty-five years, appreciation in home values is:

- 13% in IL, the lowest score compared to rest of the nation, and

- 70.9%, across 50 states. Both figures adjusted for inflation (Per Grok)

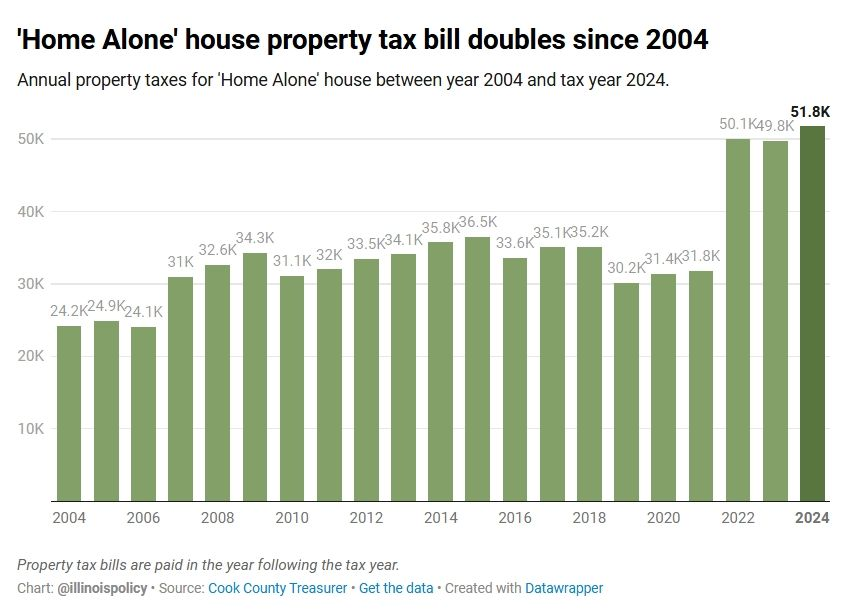

The movie HOME ALONE was a major success. It featured a home in Winnetka IL. The family that owned the home has paid over $800,000 in property taxes over the past few decades. What can the state do to provide relief for home owners? Consider:

- Caps on total payout for property taxes

- Set number of years for taxation, tax free after time limit

- No taxation if the home is paid for

- No taxation for those on fixed income

Where is the political leadership for tax relief?

VOTERS of IL have had enough!

How could IL accelerate home value appreciation? How about tax relief?