Illinois State Debt Overview (as of late 2025)

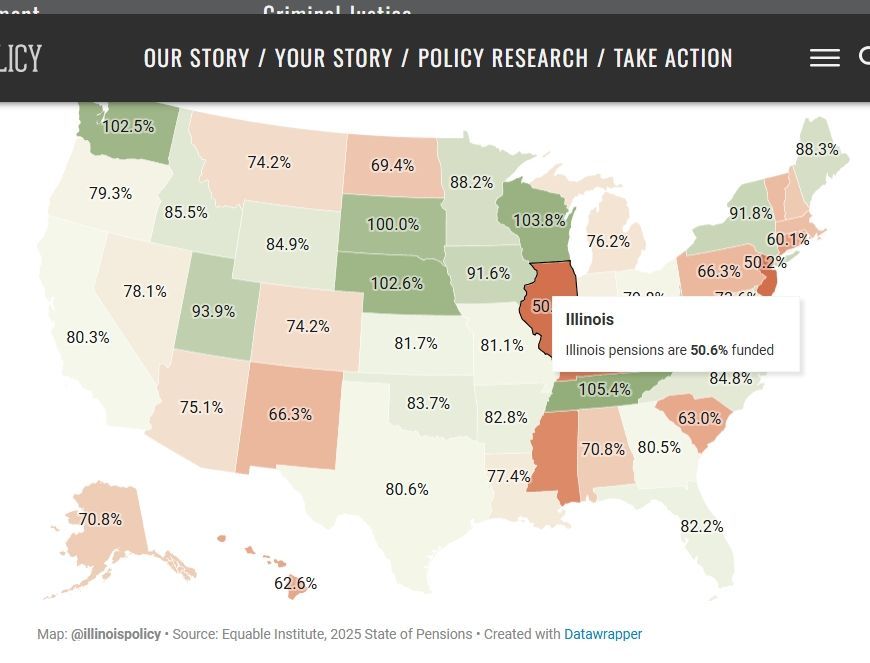

Illinois faces one of the highest state debt burdens in the U.S., driven primarily by unfunded pension liabilities (the largest in the nation), alongside bonded debt and other long-term obligations. While the state has made progress reducing its bonded debt and bill backlog over the past decade, total liabilities remain massive—$223 billion for state government alone at the end of FY2023 (latest comprehensive data), or about $17,500 per resident (3rd highest nationally). This excludes local government debt. Per Grok.

The current IL state budget for the next year is $55B, which includes some provisions for dealing with the massive level of debt accumulated over the past three decades plus under the political leadership of both parties. Pensions consume 25% of the IL state budget now, and will continue or increase at that level in future budget years.

Note that the average state payment for funding of pensions is 5.11% of the state budget compared to the 25% spend of IL. (per Grok). IL is the outlier for funding state pension systems.

Four ways for IL to break out of Pension Trap...

Illinois Local Government Debt Overview (FY2023 Latest Comprehensive Data, as of Oct 2025)

Illinois local governments (3,000+ counties, municipalities, townships, and 13,000+ school districts) carry

~$184 billion in total liabilities

Add the state debt of $223B, the combined total is $407B.

IL ranks fourth in the nation for state level debt. If we add city, township and municipal debt, the total is $407B, which moves IL to second place behind CA. Pension debt dominates (~45% of local debt), with Chicago alone at $53 billion unfunded pension debt, an amount greater than the debt of 44 states.

Local debt is less transparent than state (no centralized reporting), but Reason Foundation's 2025 analysis (covering all entities) provides the gold standard.

So how bad is it? Learn more...

IL ranks second in pension debt

A small consolation: New Jersey is first in the nation for unfunded pension debt.