Is this the best we can do? What's the path to tenth Place?

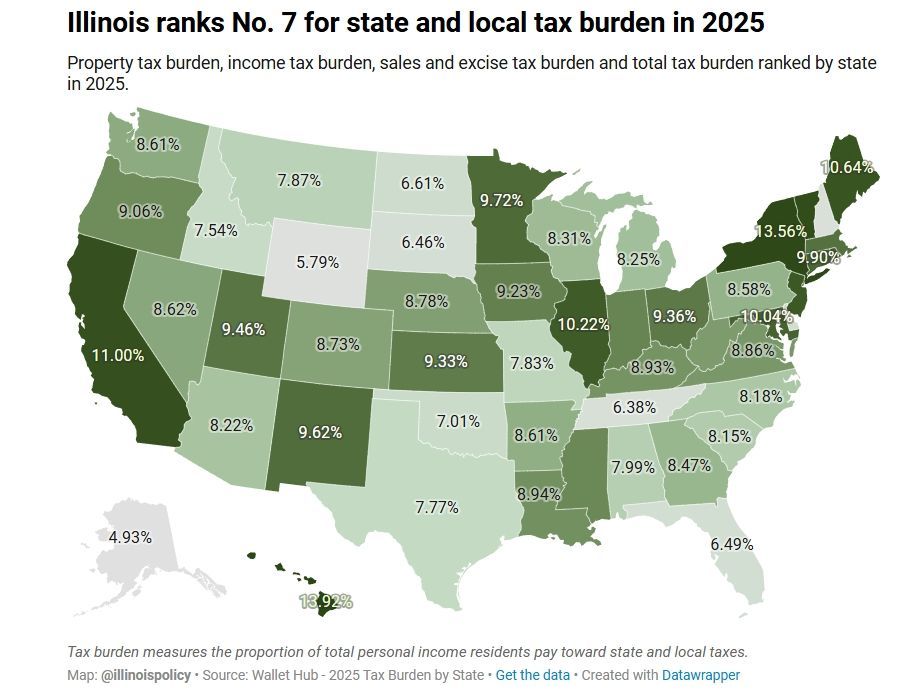

IL ranks as seventh highest state in taxes on citizens. The state takes over 10% of household income to fund all government services, payroll, debt obligations and public sector pensions.

Can IL families continue to fund all this Government?

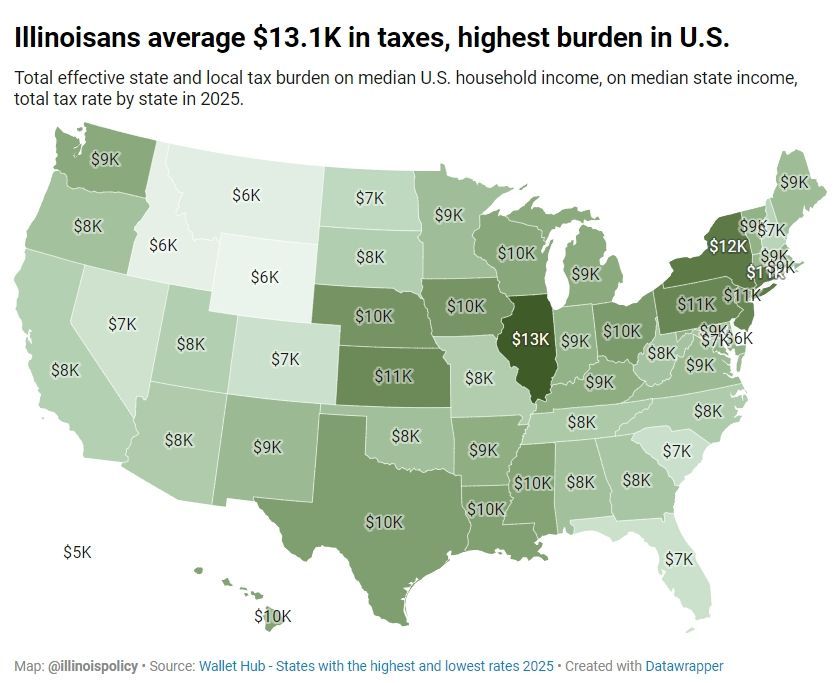

In financial terms, IL families pay the highest dollar amount in state taxes in the USA.

Are we reaching the Limits of the ability of the Private sector to fund all this government?

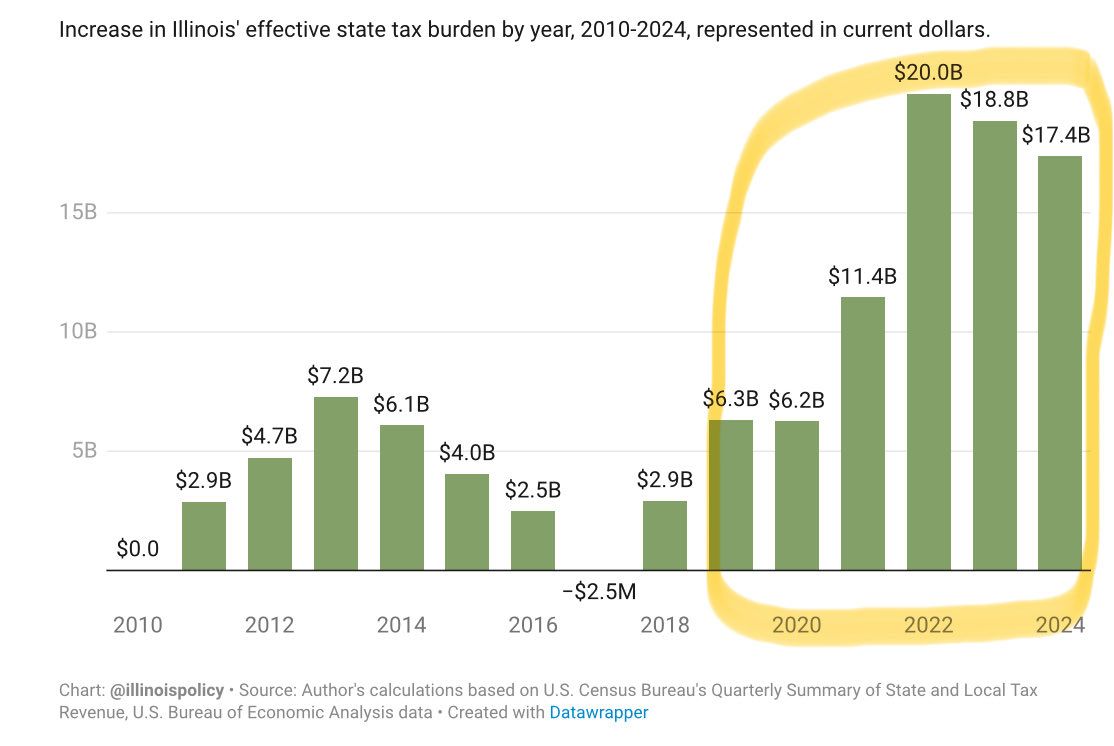

IL taxpayers are well aware of the annual increases in taxes of all kinds. The need to fund and grow government is fully supported by both political parties. Note that the pace of increases in taxes has accelerated under the current governor.

Where is the political leadership to reduce the tax burden?

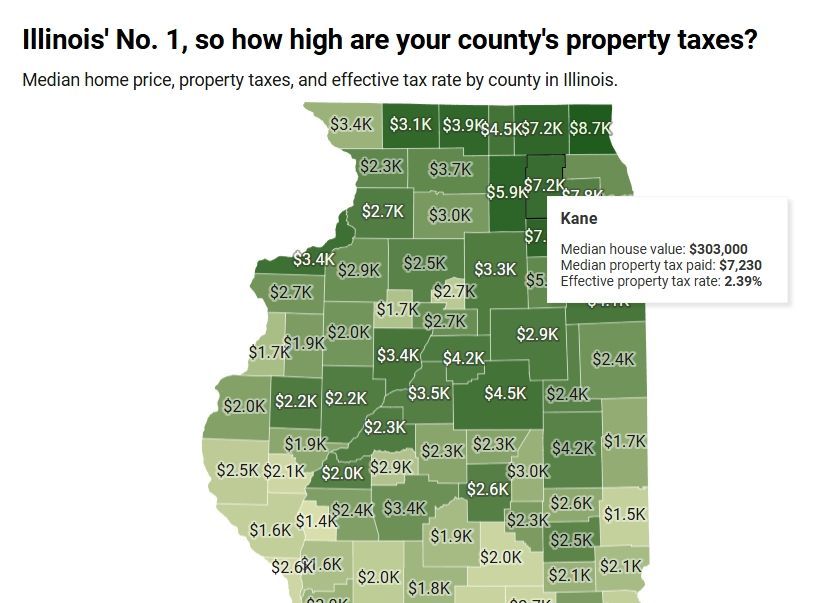

IL Property taxes are in top place in the nation, ahead of high tax states such as CA, NJ and NY. Note that the state of Florida is planning to end all property taxes in 2026.

Who will lead the effort to reduce this tax burden?

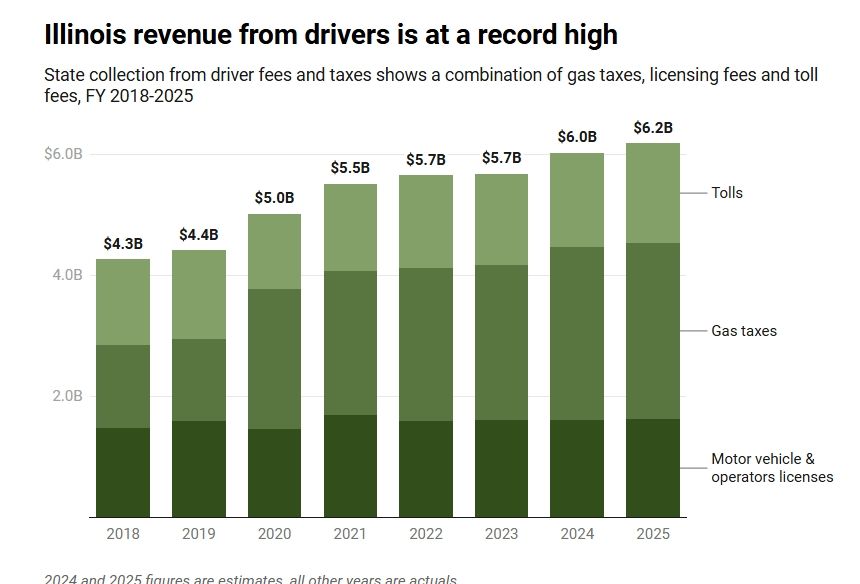

IL Gas tax is a major source of revenue for the state. The burden of a gas tax falls heavier on families with low incomes compared to higher income families who are better able to manage the costs. California ranks # 1 with a tax of 70 cents per gallon. IL ranks second with a tax of 66 cents per gallon.

Amazing how IL always ranks high in every tax category

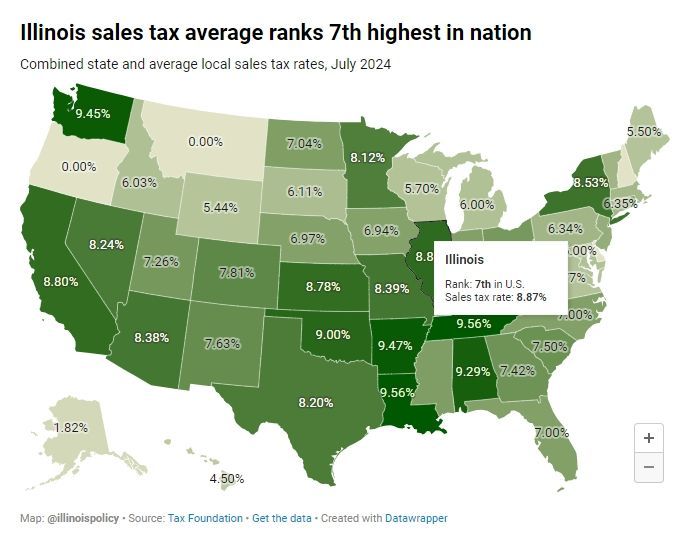

IL Sales Tax ranks seventh in the nation, at 8.87%. Sales Tax for Kane County ranges from 7% to 11%. Per media reports, there is pressure from county and municipal government to increase sales taxes at the local level. For more information on Sales Tax for your Kane County location, Click here.

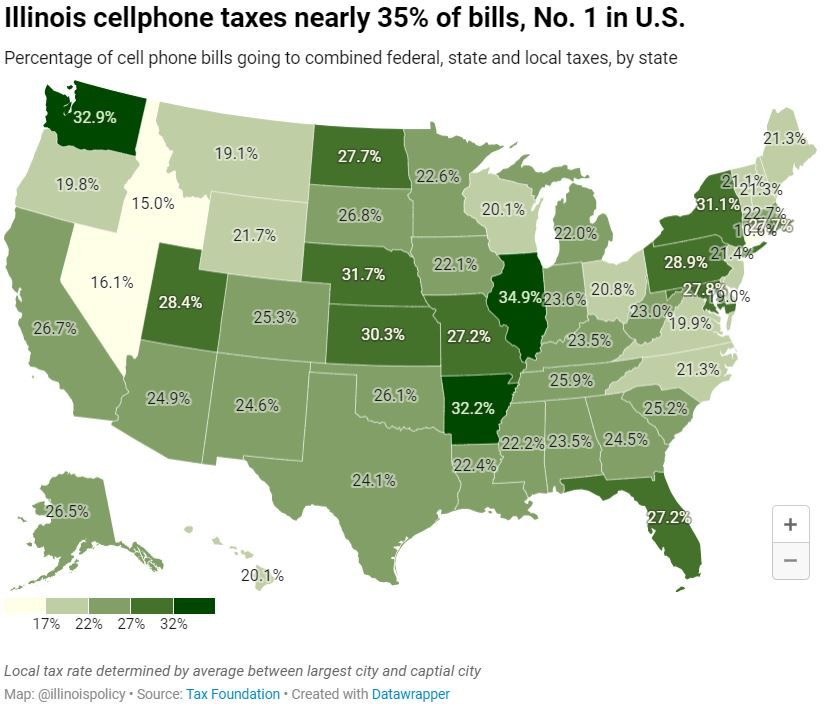

Is there any satisfaction in achieving first place for any tax?

Cell phone taxes in IL lead the nation at a rate of 34.9%. The state never misses an opportunity to raise their revenues!

IL opts out of ending taxes on tip income for workers. Is this based on solid policy ideas, or anger at the current administration?